Class

Lecture

Islamic

Financial System (Fin-5402)

Financial Crisis

“Financial crisis” broadly refers to disruptions in financial markets

causing constraint to the flow of credit to families and businesses

and

consequently having adverse effect on the real economy

of goods

and

services. The term is generally used to describe a

variety of situations in

which investors

unexpectedly lose substantial amount of their investments, and financial institutions suddenly lose significant proportion of their value.

Financial crises include, among others, stock

market crashes, financial bubbles, currency crises, and sovereign defaults.

(Collected from The Global Financial Crisis and Islamic Finance, M. Kabir

Hassan, University of New Orleans, USA Rasem Kayed, Arab-American

University, Palestine)

Causes

and consequences of financial crisis

Financial bubbles

are

generally linked to easy credit, excessive debt, speculation, greed, fraud, and corruption. Easy credit leads to lack of adequate

market discipline, which

in

turn instigates excessive

and imprudent lending. Chart 1

below presents a summary of the most frequently cited

factors

as

being potential contributors to financial crisis.

|

Chart 1:

Causes and consequences

of financial crisis

|

||

|

Causes

of financial

crisis

|

Description

|

Risk/Consequence

|

|

Leverage

|

Borrowing to finance investment

|

Bubble

that leads to bankruptcy

|

|

Asset-liability

mismatch

|

The disparity between a bank‟s deposits

and

its long term assets

leads to the inability of

banks

to renew short term debt they used to finance

long term investments in mortgage

securities

|

Bank runs1

|

|

Regulatory failure

|

Improper (insufficient/excessive) regulatory

control:

-Insufficient regulation:

1) Results

in

failure of making institutions‟

financial

situation publicly known (lack of transparency)

2) Makes

it possible

for financial institutions

to operate without having sufficient assets

to meet their contractual obligations.

-Excessive

regulations that require

banks

to increase their capital when risks

rise leading to substantial decrease in lending when

capital is

in short supply.

|

-Excessive risk-taking

-Financial crisis

(of 2008)

Potential deterioration of

financial crisis

|

|

Fraud,

corruption and greed

|

-Enticing depositors

through misleading

claims

about their investment strategies and manipulating information.

-Creating financial

assets without any real

economic activity

-Extreme economic greed overrides basic ethical consideration in investments

|

Subprime mortgage

crisis

|

|

Contagion

|

Where the failure

of one particular financial

institution to meet its

financial obligations

(due to lack of liquidity, bad loans or a sudden withdrawal of savings) causes other

financial

institutions

to be unable to meet

their financial

obligations when due. Such a failure may cause

damage

to many other

institutions and threatens

the

stability of

financial markets

|

Systemic risk2

|

|

Money

supply

|

Uncontrolled printing of paper money that is

not backed

by real assist/commodity (gold)

|

Higher inflation

|

2 Systemic risk has far-reaching implications that go beyond the institution in question and even outside the boundaries of the country that houses the failing institution. Financial globalization facilitates risk to be

transferred across national boundaries. Therefore, the failure of one participant in financial markets could lead

to global financial crises (Kaufman

& Scott, 2003). This is evident by the current global financial meltdown caused by the collapse of some US financial institutions associated with the subprime mortgage scheme

Implications

of

the global financial crisis:

Needless to say those

conventional financial institutions, by and large, were

the first to feel the full

impact of the crisis that they have initiated. The 2008-year was packed of unparalleled events, which have created mass uncertainty,

such

as:

1.

Sharp decline in

global equity markets

2.

The failure or collapse of numerous

global financial institutions

3.

Governments of a

number of industrialized

countries

allocated

in excess of $7 trillion bailout and liquidity injections to revive their economies

4.

Commodity and oil prices reached

record highs followed

by a slump

5.

Central banks

reduced interest rates in

coordinated efforts to increase liquidity and avoid

recession

and to restore

some

(confidence) in

the

financial markets.

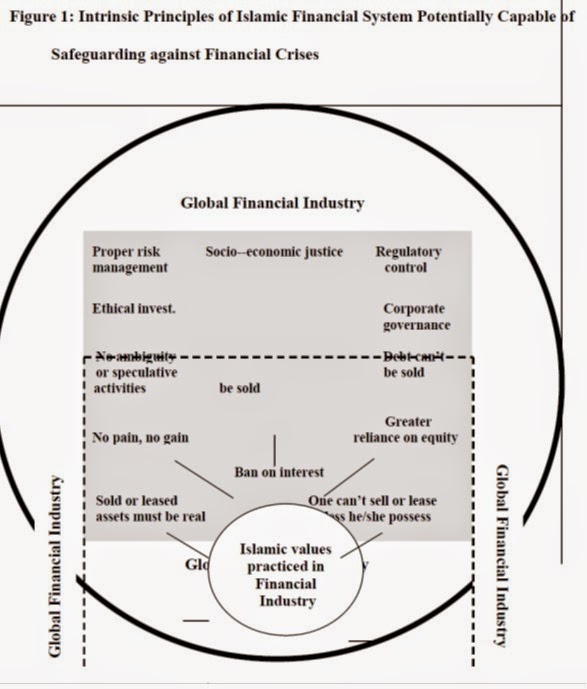

Financial crisis: Islamic solution:

Chart

2 links key principles of Islamic finance to „market failures‟ and suggests

that the likelihood of market failure will be significantly reduced, if not

eliminated, when these principles are adhered to and put into practice in all

financial transactions.

|

Chart

2: The economics

of Islamic finance and ‘market

failures’

|

||

|

Islamic finance

principle

|

Intuitive description

|

Linkage to

‘market failures’?

|

|

1. Riba prohibited

|

„Earning money from money‟ or

interest, is prohibited. Profit,

which is created

when „money‟ is

transformed into capital via effort, is allowed. However,

some forms of debt are

permitted

where these are linked to „real

transactions‟, and where

this is not used for purely speculative

purposes

|

A real return for real effort is

emphasised (investments cannot be

„too safe‟), while speculation is

discouraged (investments cannot be

„too risky‟). This might have

productive efficiency spillover benefits

(„positive externalities‟) for the

economy through linking returns to real entrepreneurial effort

|

|

2. Fair

profit sharing

|

Symmetric profit-sharing (eg.

Musharakah) is the

preferred contract form, providing effort

incentives for the manager of the

venture, while both the

investor and management have a fair

share

in the venture‟s realised profit (or loss)

|

Aligning the

management‟s incentives

with those of the investor may (in contrast to pure debt financing) once again have productive

efficiency

spillover benefits for the economy, through linking realisable returns to

real entrepreneurial effort

|

|

3. No

undue ambiguity

or uncertainty

|

This principle

aims to eliminate

activities or contracts

that are

gharar, by eliminating

exposure of either party to excessive

risk. Thus the investor and manager must be

transparent in writing

the contract, must take steps to mitigate controllable risk, and

avoid speculative

activities with

high levels

of

uncontrollable

risk

|

This may limit the extent to which

there

are imperfect and asymmetric

information problems

as part of a

profit-sharing arrangement.

Informational problems might, for example, provide

the conditions

for

opportunistic behaviour by the venture

(moral hazard),

undermining investment in all similar ventures in

the first instance.

|

|

4. Halal versus haram

sectors

|

Investing in certain haram

sectors is prohibited (eg, alcohol,

armaments, pork, pornography, and tobacco) since they are

considered to cause individual

and/or collective

harm.

|

Arguably, in certain sectors, there are

negative

effects

for society that the investor or venture

might not otherwise take

into account (negative

externalities). Prohibiting investment

in these sectors might limit these externalities

|

|

Source: (Iqbal &

Llewellyn, 2002 cited in Oxera, 2007, p. 2).

|

||

The regulatory authorities, experts in Sharia‟h law

and teachings need to address the issues of intermediation, risk management and

financial engineering within the

framework of

Islamic finance. Islamic finance Policy makers must also strive to

transform Islamic finance model into working policies and

build enabling institutions to overcome

the challenge of implementing

Islamic finance

at global stage.

Top 10 World’s Biggest Financial Crises Ever

Article by Jayasmita Ray, March 23, 2015

A financial crisis is said to

occur when an asset loses a large part of its face value. This can lead to a

wide range of adverse consequences such as a fall in output or stagnancy,

currency crashes and worse, sovereign defaults. Such notable crises have been

occurring since 4th century BCE (Dionysus of Syracuse) and have continued on

different scales and levels. They have far reaching effects into the very

roots of the economy. The causes of the crises can be manifold, and they have

evolved as man as discovered means to propel society to higher levels of

development.

Our world is now very

inter-connected through currency markets, trade relations and capital flows.

The advent of multinational corporations has also added to these

inter-linkages. Thus, crises that may occur in one country can often get transmitted

to another like a bad case of financial influenza driven by fears and

speculation. In view of the various crises that have occurred in the world over

time, i present a list of 10 notable ones in terms of the transforming effects

they had on a wide scale:

10. Black Monday

In the finance world, The Black Monday refers to the time of

October 19, 1987. During that day, there was a widespread stock market crash

all around the world. The beginning of this crash originated in Honk Kong and

eventually spread to Europe. Ultimately, the United States was affected as

well. The Dow Jones dropped by 22.1%, and it took almost 2 years to reach even

the previous high of 1987. This recovery occurred despite fears that the crash

would spell economic gloom like the 1930s. Many explanations exist for this

sudden crash, but none is conclusive. Program trading is one popular

theory. It is said that the level of computerization of stock trading had gone

up during the 1970s. As a result, computers often performed arbitrage based on

external prices. Thus when prices of stock fell, they rapidly sold more and

more, thereby worsening the crash. However, this has been contested because of

the origin of the crises being in Honk Kong, whereas program trading was

more prevalent in USA and also due to the level it spread across the

globe. Institutional rigidity and market psychology have been cited as other

causes.

9. Dot-Com Bubble

This speculative bubble related to internet based companies

saw massive rises in equity stock values of industrialized nations from

1997-2000. This bubble began because of easy credit availability in 1997-1998.

These start-up companies wanted to establish a high market share by

establishing more coverage. This meant that many of the services were freely

provided, and large operational losses were actually occurring. They wanted to

establish a brand and then charge profitable rates. The phrase “Get large

or get lost” operated in the minds of company founders. The quick

expansion of growth rates of these companies led to a self-perpetuating boom in

the share prices. This was riding vastly on hopes of further expansions due to

technology. However, in early 2000, the FED spiked interest rates 6 times and

the economy began to slow down. The market was also triggered further by the

findings of the Microsoft vs USA case. A bearish trend started prevailing, and

by 2001, most of the dot-com companies crashed after finishing off their

venture capital. These failed companies called “dot-bombs” never actually made

any profit.

8. Credit Crisis of 1772

This crisis originated in London and spread to other parts of

Europe, such as Netherlands. Ironically, it had been preceded by a period of

great prosperity for Britain. The mid 1760s and 1770s saw a credit boom which

spurred greater manufacturing and industrial activity. The period of 1770 to

1772 was politically very stable for Britain and its colony, America. However,

there was a deeper systemic problem that prevailed under the surface of this

prosperity. Speculative practices thrived to generate more credit, and this led

to a false feeling of optimism in the market. On June 8, 1772, the fleeing of

one of the partners of the Banking House “Neal, James, Fordyce and Down” due to

failure to repay debts led to panic. During that time, investment was heavily

dependent on the confidence of the market as even today. The confidence of the

people in banks collapsed, and they rushed to reclaim their money. As a result,

several bankruptcies were reported in London. In order to repay its debts,

London exerted further pressure on the tea colonial trade to repay its debts.

This eventually led to the protest of American colonies of New York, Boston,

etc led to the famous Boston Tea Party of 1773.

7. OPEC Oil Price Shock (1973)

his crises began in 1973 when the member countries of the

OPEC (Oil and Petroleum Exporting Countries) declared an oil embargo

(prevention of trade). This was done specifically in retaliation to USA’s

unflagging supply of arms to Israel which was retaliating against Arab warfare

on its holiest day that day. This lasted till March 1974. The negotiations by

the Nixon Administration with Israel and the other Arab countries eventually

led to the end of this embargo. However, even before this, the other factor

that operated was the collapse of Bretton Woods which led different economies

to use their own respective floating currencies. However, oil was priced in

dollars and the depreciation of several currencies that followed (due to

fluctuations to adjustment that led to money printing) also reduced the

earnings of the oil exporting nations. Thus raising oil prices was an effective

means to stabilize their real incomes over the years. The embargo that followed

later because of the political warfare aspect eventually forced the developed

nations to consider energy conservation and a far more restrictive monetary

policy to curb inflation.

6. 1998 Russian Crises

This crises, also known as the “rubble crises” saw a wide

ranging effect on countries of the world such as the Baltic States, Moldova,

Kazakhstan, Ukraine, USA, Belarus, Uzbekistan etc. There was a wide range of

reasons for this crises. The internal decline in productivity, ballooning

fiscal deficit which was aggravated further by the Chechnya War which ended in

1996 were enough to set the stage for other events that triggered the crises.

The 1997 Asian crises led to a fall in prices of metals and oil which severely

affected the exchange rate in real terms. The rubble had been kept artificially

fixed all this time, and when the value of these important capital goods fell,

there was a fall in GDP, unemployment and capital flight. Political uncertainty

occurred when there was a massive dismissal of cabinet members by the President

of Russia. Despite the efforts to attract more capital and generate liquidity,

the debt on wages of the people (particularly miners) grew. The switch to a

floating exchange rate led to a massive depreciation that didn’t help investor

confidence. It was really the rise in oil prices in 1999-2000 that helped

Russia to finally have a trade surplus and the domestic industries had

benefited from the spike in prices of imports as a result of depreciation.

5. 1997 Asian Crises

The Asian Crises originated in a rather small economy called

Thailand. The country had experienced rapid expansion in the 1980s and most of

the 1990s. However, much of this growth had previously been financed by

domestic savings and industrialization occurred due to Japanese subsidiaries.

However, speculative capital flows, particularly from developed economies

eventually led to currency crises. The Thai government had maintained a fixed

exchange rate and rising demand for Thai currency, baht had led to increase in

the money supply that threatened to make the exchange rate non-competitive.

Over time, imports rose, and exports fell. The trade deficit worsened as a

result. This led to a fall in investor’s confidence. The souring of Japanese

currency also contributed to fall in desirability of the “emerging economies”

attractiveness. The handover of Honk Kong sovereignty on July 1, 1997 was the

final trigger for growing panic in the market about the success of Asian

economies. The next day, the Thai stock market crashed, and the government was

forced to allow the currency to float and depreciate. The crises had officially

begun. It spread widely to most of the South East Asian economies particularly

and heavily affected USA.

4. Wall Street Crash

This was the most shocking crash of the United States Stock

Market. It began in October 1929. Also known as black Monday, it came as a blow

to the market which was riding on the highs of early 1920s. There was a feeling

of euphoria in the market that the stock market would rise indefinitely, and

that wealth would keep on rising. There was a warning bell of crash in March

1929 that had been warded off by the efforts of National City Bank. The

previous prosperity had encouraged people to take more loans, and the stock

market rise was considered a good sign. However, the economy was not doing

well in the late 1920s. The production of steel, construction activity and car

sales were all going down. Consumers had built up large debts due to easy

credit. An over-supply of wheat depressed prices and farmers were losing

heavily. The fall of commodity markets shook American confidence and eventually

the faltering trend of the stock market reflected this. Thus a period of panic

selling started and further worsened the self-fulfilling prophecy that the

market would go down even more.

3. The Great Depression

It was the worst economic disaster of the 20th century and

started in 1930s. Many countries of the world, especially the heavily

industrialized ones were badly affected by contraction in output growth, high

unemployment, severe deflation and fall in trade. This lasted till 1933 in USA,

but many countries were affected even till World War II period. Many

explanations operate to explain why this crises happened in the first place.

The major trigger is said to be the Wall Street Crash of 1929 which caused many

USA citizens to lose a chunk of their incomes. An agricultural drought

occurred in 1930 that worsened the agricultural scenario in the country. There

was already a contraction in steel, mining and construction prevailing. The

enactment of Smoot-Hawley Act by USA to protect the competitiveness of its

currency also worsened international trade scenario. The decline of USA led to

a transmission effect to other parts of the world. Each country’s difficulties

were either worsened and improved because of prevailing structural component

and regulatory environment. However, one aftermath of this event was the

implementation of social democracy in European countries after World War II.

2. Eurozone Crises

This is an ongoing crisis that began in 2009 in the European

region. It occurred due to growing fears of defaults by sovereigns of the

European Union, particularly Greece, Portugal,Ireland, Spain and Italy. It

exposed the fiscal inefficiencies of many countries. Previously in 1992, the

members of the EU had signed the Maastricht Treaty which designated the levels

of necessary levels of fiscal performance. However, countries like Greece spent

heavily on public sector wages and social payments. The means to achieve the

funds was done by securing future payments. This meant that they borrowed today

on the basis of revenue expected to be generated later. Unfortunately, the

economic slowdown in 2008 had trimmed these future revenues. Practices had

been undertaken to evade international agreements. They were now exposed. The

banking crashes, bursting of property bubbles in the countries prompted bailout

programs to generate liquidity for these cash-strapped nations. However, much remains

to be seen before relatively bigger economies such as Spain and Italy can be

helped entirely. The main problem that exists even today is the nature of the

common euro currency that makes monetary policy inflexible while fiscal policy

was greatly undermined already.

1. Financial crises of 2008

This crises was considered the worst one since the Great

Depression itself. This easy availability of credit propelled greater demand

for housing and a bubble started. However, once this ended, there was a big

crash in housing prices. Mortgage values now exceeded the values of houses

bought. A great level of lending to less credit worthy borrowers had also

prevailed, called sub-prime lending. The existence of financial instruments

like Collateralized Mortgage obligations (CMOs) allowed the effect to spread to

the entire financial market. Financial innovations led to far greater risk

taking appetite. However, the eventual collapse of trust in the market

froze lending activity. The real economy had already begun to be affected since

2006. In 2008, this decline in investment spread further even to consumer

goods. Over time, in the summer when spending on consumption fell massively,

the economy began to decline. Big banking organizations like the Lehman

Brothers collapsed and massive bailouts started. The USA also began to import

less from the other countries and their exports languished. Thus their GDPs too

began getting affected through this route and the various financial instruments

that bound the world economy together. Credit became scarce, confidence fell

and unemployment continues to be a problem even now in the USA

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন