Class Lecture (Final)

Islamic Financial System (Fin-5402)

Capital Market

Definition of Stock/

Equity Market:

— A stock market or equity

market is a public entity for the trading of company stock (shares)

and derivatives at an agreed price.

— These are securities listed

on a stock exchange as well as those only traded privately.

— The stocks are listed and traded on

stock exchanges which are entities of a corporation or mutual

organization. The largest stock market in the USA, by market

capitalization, is the NYSE.

Definition of Stock Exchange:

—

Stock

exchange can be defined as “an association, organization, or an individual who

is established for the purpose of assisting, regulating, and controlling

business in buying, selling and dealing in securities.”

— A market in which securities are

bought and sold: "the company was floated on the Stock

Exchange".

— The initial offering of stocks and

bonds to investors is by definition done in the primary

market and subsequent trading is done in the secondary market.

— A stock exchange is often the most important

component of a stock market.

— Supply and demand in stock markets are driven

by various factors that, as in all free markets, affect the price of

stocks.

The Primary market

is the market where investors purchase newly issued securities.

Initial public offering (IPO): An initial public offer occurs when a company offers stock for sale to

the public for the first time.

An IPO involves several steps.

1.

Company

appoints investment banking firm to arrange financing.

2.

Investment

banker designs the stock issue and arranges for fixed commitment or best

effort underwriting.

3.

Company

prepares a prospectus (usually with outside help) and submits it to the Securities

and Exchange Commission (SEC) for approval. Investment banker circulates

preliminary prospectus (red herring).

4.

Upon

obtaining SEC approval, company finalizes prospectus.

5.

Underwriters

place announcements (tombstones) in newspapers and begin selling shares.

Underwriting:

Securities underwriting refers

to the process by which investment banks raise investment capital from investors on

behalf of corporations and governments that are issuing securities (both equity and debt capital). The services of

an underwriter are typically used during a public offering.

This is a way of distributing a newly issued security, such as stocks or

bonds, to investors. A syndicate of

banks (the lead managers) underwrites the transaction, which means they have

taken on the risk of distributing the securities. Should they not be able to

find enough investors, they will have to hold some securities themselves.

Underwriters make their income from the price difference (the "underwriting spread") between the price they

pay the issuer and what they collect from investors or from broker-dealers who

buy portions of the offering.

The Secondary market is the market where investor trade previously issued securities. An

investor can trade:

— Directly with other investors.

— Indirectly through a broker who

arranges transactions for others.

— Directly with a dealer who buys and

sells securities from inventory.

A

secondary market

can be organized as an exchange where buyers and sellers meet in one central

location to conduct trades. An example of an exchange is the New York Stock

Exchange. A secondary market can also be organized as an over-the-counter

market. In this type of market, dealers in different locations buy and sell

securities to anyone who comes to them and is willing to accept their prices.

An example of an over-the-counter market is the federal funds market.

Stock Exchange in Muslim Countries:

Many

Muslim countries, or those with a majority Muslim population, have well

established stock markets, for example, Bangladesh, Egypt, Indonesia, Malaysia

and Pakistan. These stock exchanges are basically Western style markets

tolerating practices that may not strictly adhere to Islamic principles.

Importance/Roles/Functions

of Stock Market:

The stock exchange helps achieve

various benefits. It:

1.

provides

a market place where a large number of sellers and buyers can meet,

2.

helps

remove the apprehension of investors, the buyers, regarding future liquidity

problems, that may encourage the investors to accept a lower rate of return

than they would have done in the absence of the exchange and consequently lead

to reducing the cost of equity capital, hence reducing the average cost of

capital of the firm,

3.

helps

provide more representative prices of securities than the case would be with

separately organized markets,

4.

provides

a means of testing the validity of securities by assigning a value to these

securities, that is influenced by the views of specialized experts in the

market, and

5.

Provides

an effective way of absorbing new issues of securities which helps corporations

to raise funds.

Islamic Stock Exchange:

Malaysia

is making solid progress in establishing the necessary infrastructure to

facilitate stock trading in accordance with Islam. Islamic broking houses and

Islamic managed funds operate and a separate “Islamic Index” has been

established comprising 179 permissible stocks on the Kuala Lumpur Stock

Exchange.

Listing on an Islamic stock exchange:

The

listing requirements for an Islamic stock market will require scrutiny, not

only of the financial performance and soundness of firms, but also of the

religious acceptability of their business activities.

Non-Muslim in Islamic Stock exchange:

Example,

where the major stockholders are not Muslims, but conduct their affair in a way

that does not contravene any principles of Islam. Should these firms be allowed

to list on an Islamic stock exchange?

Bank

Islam Malaysia, for example, conducts a substantial amount of its financing

activities with firms that are owned by non-Muslims. In Bangladesh, Islamic

bank also provide services for non-muslim clients.

Definition of

stock:

A stock represents a

share of ownership of a corporation, or a claim on a firmʹs earnings/assets.

Stocks are part of wealth, and changes in their value affect peopleʹs

willingness to spend. Changes in stock prices affect a firmʹs ability to raise

funds, and thus their investment.

Definition of

'Common Stock'

A security that

represents ownership in a corporation. Holders of common stock exercise control

by electing a board of directors and voting on corporate policy. Common

stockholders are on the bottom of the priority ladder for ownership structure.

In the event of liquidation, common shareholders have rights to a company's

assets only after bondholders, preferred shareholders and other debtholders

have been paid in full.

In the U.K., these are called "ordinary shares."

In the U.K., these are called "ordinary shares."

If the company goes bankrupt, the common stockholders will

not receive their money until the creditors and preferred shareholders have

received their respective share of the leftover assets. This makes common stock

riskier than debt or preferred shares. The upside to common shares is that they

usually outperform bonds and preferred shares in the long run.

Definition of

'Preferred Stock':

A class of ownership

in a corporation that has a higher claim on the assets and earnings than common

stock. Preferred stock generally has a dividend that must be paid out before

dividends to common stockholders and the shares usually do not have voting

rights.

The precise details as to the structure of preferred stock is specific to each corporation. However, the best way to think of preferred stock is as a financial instrument that has characteristics of both debt (fixed dividends) and equity (potential appreciation). Also known as "preferred shares".

The precise details as to the structure of preferred stock is specific to each corporation. However, the best way to think of preferred stock is as a financial instrument that has characteristics of both debt (fixed dividends) and equity (potential appreciation). Also known as "preferred shares".

'Common Stock' and Preferred stock in Islam:

Ownership shares issued by corporations and traded by investors include

both common stock and preferred stock. While there are several ways in which

the two types of stock differ, the most significant way, from an Islamic legal

point of view, is that preferred stocks guarantee the amount of the dividend.

Such a predetermined and guaranteed rate of return is prohibited for the

reason that it may be classified as riba. Thus, while an investor may share the

risks of ownership with other investors, the preferred status of the preferred

stock means that there is extra compensation for the owner for which the owner

has not had to pay. This, in simplified terms, amounts to riba al fadl. In

Lesson Two of this course, we will take a detailed look at riba and the forms

it may take. For similar riba-based reasons, fixed-income securities,

convertible notes, and the like are also prohibited.

As a general rule, then, Muslim investors may trade only in common

stock.

In some cases, however, preferred stock may be offered without a fixed

dividend or without a dividend at all. Even so, it is the right of the

shareholders to change those terms through a vote at their shareholders?

meetings. Thus, while a Muslim investor may purchase such stock, s/he may hold

it only for as long as it carries no fixed dividend. If the status of the stock

changes as a result of a vote, the Muslim investor will have to liquidate

his/her interest in the company immediately. And if a fixed-amount dividend is

received before the stock can be sold, the entire amount of the dividend will

have to be given away as charity.

Some concept and their application Islam:

'Insider

Trading':

The buying or selling

of a security by someone who has access to material, non-public information

about the security. Insider

trading can be illegal or legal depending on when the insider makes the trade:

it is illegal when the material information is still nonpublic--trading while

having special knowledge is unfair to other investors who don't have access to

such knowledge. Illegal insider trading therefore includes tipping others when

you have any sort of nonpublic information. Directors are not the only ones who

have the potential to be convicted of insider trading. People such as brokers

and even family members can be guilty.

Insider trading is legal once the material information has been made public, at which time the insider has no direct advantage over other investors. The SEC, however, still requires all insiders to report all their transactions. So, as insiders have an insight into the workings of their company, it may be wise for an investor to look at these reports to see how insiders are legally trading their stock.

Buying on margin

or Margin trading:

Margin

buying refers to the buying of securities with cash borrowed from a broker, using other securities as

collateral. This has the effect of magnifying any profit or loss made on the

securities. The securities serve as collateral for the loan. The net value—the difference

between the value of the securities and the loan—is initially equal to the

amount of one's own cash used. This difference has to stay above a minimum margin requirement, the purpose of which is to protect the

broker against a fall in the value of the securities to the point that the

investor can no longer cover the loan.

Example:

Jane buys a share in a company for $100 using $20

of her own money and $80 borrowed from her broker. The net value (the share

price minus the amount borrowed) is $20. The broker wants a minimum margin

requirement of $10.

Suppose the share price drops to $85. The net value

is now only $5 (the previous net value of $20 minus the share's $15 drop in

price), so, to maintain the broker's minimum margin, Jane needs to increase this

net value to $10 or more, either by selling the share or repaying part of the

loan.

Islamic perspective margin trading:

From an

Islamic perspective margin trading is clearly unacceptable. This has been

reinforced by the Council of the Islamic Fiqh Academy (CIFA) which considered

margin trading at its 1993 meeting. The CIFA ruled that it is not permissible

to borrow money with interest from a stockbroker, or other party, to buy shares

and to deposit them as security for the loan. However, this does not outlaw the

practice entirely, as it is possible to construct non-interest bearing

financial contracts to achieve the same thing. For example, in Malaysia, Bank

Islam Malaysia Berhad offers share financing through Mudarabah profit sharing

contracts.

Short Selling'

The sale of a security that is not owned by the seller, or

that the seller has borrowed. Short selling is motivated by the belief that a

security's price will decline, enabling it to be bought back at a lower

price to make a profit. Short selling may be prompted by speculation, or by the

desire to hedge the downside risk of a long position in the same security or a

related one. Since the risk of loss on a short sale is theoretically infinite,

short selling should only be used by experienced traders who are familiar with

its risks.

Consider the following short-selling example. A trader believes that stock SS which is trading at $50 will decline in price, and therefore borrows 100 shares and sells them. The trader is now “short” 100 shares of SS since he has sold something that he did not own in the first place. The short sale was only made possible by borrowing the shares, which the owner may demand back at some point.

A week later, SS reports dismal financial results for the quarter, and the stock falls to $45. The trader decides to close the short position, and buys 100 shares of SS at $45 on the open market to replace the borrowed shares. The trader’s profit on the short sale – excluding commissions and interest on the margin account – is therefore $500.

Suppose the trader did not close out the short position at $45 but decided to leave it open to capitalize on a further price decline. Now, assume that a rival company swoops in to acquire SS because of its lower valuation, and announces a takeover offer for SS at $65 per share. If the trader decides to close the short position at $65, the loss on the short sale would amount to $15 per share or $1,500, since the shares were bought back at a significantly higher price.

Islamic perspective

of Short Selling'

Umer

Chapra strongly advocates the abolition of short selling in an Islamic market,

arguing that such sales are speculative and fail to perform any useful economic

function. The public interest, masalahah, is better served by

prohibiting short sales. The element of speculation involved in short sales

further suggests that short selling is unacceptable.

Speculations and

arbitrage:

SPECULATION : It is the transaction of members to buy or sell

securities on stock exchange with a view to make profits to anticipated raise

or fall in price of securities.

A

speculator will buy stock in anticipation of prices rising usually with a short-term

horizon. The danger of this, as observed by Brailsford and Heaney (1998), is

that what is initially planned as a short-term position, with a sale to be

completed before taking delivery of the stock, may well result in a longer term

position when the stock does not perform as expected. Such purchases are often

financed on margins or other forms of borrowing.

A speculator

will sell in anticipation of prices falling. This strategy may involve a short

sale whereby the speculator borrows stock from a broker with a view to

subsequently buying it at a lower price, thereby completing the deal.

Arbitrage: The simultaneous

purchase and sale of an asset in order to profit from a difference in the

price. It is a trade that profits by exploiting price differences of identical

or similar financial instruments, on different markets or in different forms. Related

to speculation is the practice of arbitrage. An arbitrageur is a particular type

of speculator who seeks to obtain a risk free return with a zero investment. An

example of a potential arbitrage opportunity is the existence of identical

assets at different prices in different markets. Such practices are more

difficult with modern communications and computerised trading, as price

discrepancies in different domestic markets are quickly eliminated from the system.

Arbitrage will be regarded as one aspect of speculation.

Islamic Perspective of

Speculations and arbitrage:

Islamic

economists and scholars that speculation, as described above, is unacceptable

because of its association with gambling and excessive risk taking. In

addition, speculation creates volatility. This undermines the orderly

functioning of the stock market while the profits of speculators are achieved

at the expense of other investors. Any potential benefit of speculation, for

example by injecting liquidity into the market is not considered by Islamic

scholars to outweigh the negative aspects. If any activity is deemed to be

forbidden and Haram, that activity cannot be acceptable under any circumstance.

BROKER: He is one act as an intermediary on behalf of others. A broker in a

stock exchange is a commission agent who transacts business in securities on

behalf of non-members.

— A broker deals with the jobber on

behalf of his clients. in other words, a broker is a middleman between a jobber

and clients

— A broker is merely an agent, buying

or selling securities on behalf of his clients

— A broker gets only commission for his

dealings

— The

broker deals in all types of securities

Definition of

'Hedge':

Making an investment to

reduce the risk of adverse price movements in an asset. Normally, a hedge

consists of taking an offsetting position in a related security, such as a

futures contract. An example of a

hedge would be if you owned a stock, then sold a futures contract stating that

you will sell your stock at a set price, therefore avoiding market fluctuations. Hedging naturally belongs to Islamic economic

objectives as long as it does not involve pure speculation and gambling-like

activities

Regulatory

body:

SEC-securities and exchanges

commission

CRB-Company Regulatory body

SAC-sharia Advisory council

Islamic

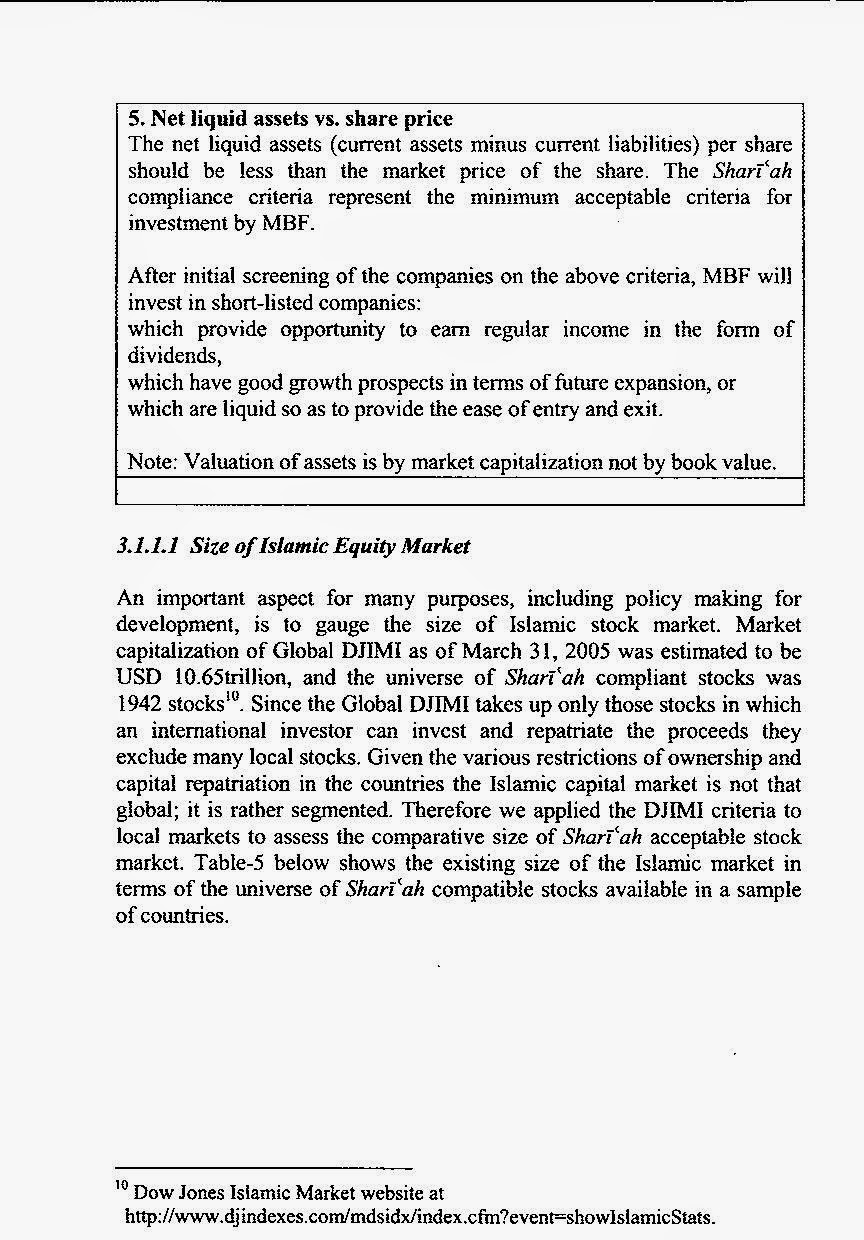

capital market screening system:

(Collected

from :islamic capital market product: development and challenges, published

byIRTI,IDB)

Informative post.Thanks for sharing.

উত্তরমুছুনOutsource Series 24