Class

Lecture

Islamic

Financial System (Fin-5402)

Economic and Financial system, Financial markets and Islamic

applications

Economic system:

An economic system is a

collection of institutions set up by society to deal with the allocation of

resources, production and goods and services, and the distribution of the

resulting income and wealth.

Islamic Economic system:

A collection of institutions

(that is, formal and informal rules of conduct and their enforcement

characteristics) designed by the Law-Giver (that is, Allah (swt) through the rules

prescribed in the Qur’an,

operationalized by the sunnah of

the Prophet (pbuh) and extended to new situations by ijtihad) to deal with

allocation of scarce resources, production and the exchange of goods and

services and the distribution of the resulting income and wealth.

Types of economy:

1.

Market/Capitalist Economy: is

one in which individuals and private firms make the major decision about

production and consumption Market economy: an economy that allocates

resources through the decentralized decisions of many firms and

households as they interact in markets for goods and services. Example-UK (came

to close in 18th century).

2.

Laissez – faire economy: the

extreme case of a market economy, in which Governments keeps its hands off

economic decisions, is called a Laissez – faire economy.

3.

Command/Planned/Centralized/Communist/Socialist

Economy: is one in which the government makes all important decisions about

production and consumption. Example-ex-soviet union

4.

Islamic Economy: the

economy which runs according to the law of welfare, justice and Islamic

Shariah. Example-Medina state in 7th century, Iran (came to

close).

5.

Mixed Economy: it

includes the elements of both market and command economy. Example-almost all

economy of the world, Bangladesh, India etc

Comparative

analysis of different doctrines:

Figure-1: Economic Doctrines of life

|

Capitalism

|

Communism

|

Islam

|

|

Worldly

life & confused about Hereafter life

|

worldly

life is the only life & no Hereafter life

|

Worldly

life & Hereafter life

|

|

There

is a GOD but forget in daily life

|

There

is no GOD or creator

|

ALLAH

is the only creator and God

|

|

Self-satisfaction

|

Self-satisfaction

through state intervention

|

Satisfaction

of ALLAH

|

|

Self-interest

&Rationalism is the sole authority of decision making

|

Rationalism

and state is the sole authority of decision making

|

Individualism

&Rationalism through moral filtering is a part of decision making

|

|

Competitive

market: survival for the fittest

|

State

control the market

|

Combination

of competition and state intervention: Humanity & Philanthropy

|

|

No

value judgment

|

No

value judgment

|

Value

judgment, social, national, cultural values

|

|

Independent

of revealed religion, Religion is unreliable

|

No

religion

|

Religion

is key determinant

|

|

Earning

at any way

|

Earning

at any way

|

Earning

at honest way

|

|

Economic Laws are like

physical laws

|

Economic Laws are like

physical laws

|

Economic laws are like natural laws

|

|

Economics is a positive

science as like as biology, physics which have no value, value neutral

|

Economics is a positive

science as like as biology, physics which have no value, value neutral

|

Economics is value oriented. Permissible &

prohibition have to be observed

|

|

Little concern for poor

humanity

|

Theoretically, concern for

poor humanity but not practically

|

Major concern for poor. Poverty alleviation by

Zakat, Sadaqa & gives emphasis on economic progress

|

Figure-2: Stages of life and difference

in Visions of two consumers (Schematic chart)

|

Islamic man

|

Conventional man

|

|

Born (coming

from Heavenly life)

↕

Education life

(worldly+ Religious)

↕

Working/professional

life (earning an honest way directed by Religion)

↕

Family life

(Religious)

↕

Life Style

(Moderate/simple

life style)

↕

Worldly life

(Enjoy the worldly life & Prepare for Hereafter life)

↕

Retired life

(reading, travelling, Ibadah, etc.)

↕

Death (start

the journey for Hereafter life )

|

Born (Natural

Law of human life)

↕

Education life

(worldly)

↕

Working/professional

life (earning an any way)

↕

Family life

(Wealth)

↕

Life Style

(Luxurious

life style)

↕

Worldly life

(Enjoy the worldly life-Only place for success & rewards)

↕

Retired life

(reading, travelling, etc.)

↕

Death (Natural

departure)

|

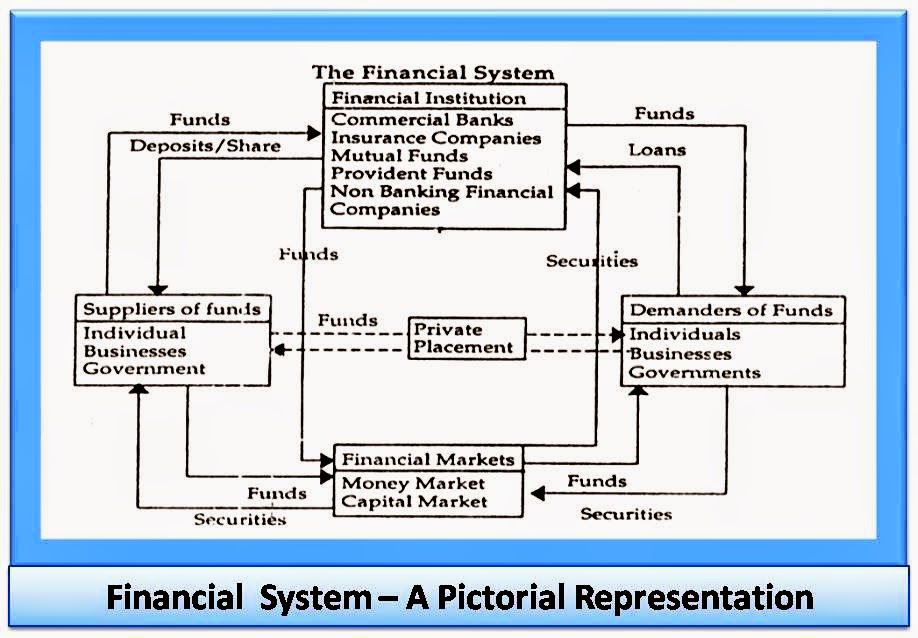

Financial system:

A financial system consists of institutional

units and markets that interact, for the purpose of mobilizing funds for

investment and providing facilities, including payment systems, for the

financing of commercial activity.

An institutional unit is an entity, such as a

household, corporation, or government agency, that is capable in its own right

of owning assets, incurring liabilities, and engaging in economic activities

and transactions with other entities.

The role of financial institutions within the

system is primarily to intermediate between those that provide funds and those

that need funds, and typically involves transforming and managing risk.

Particularly for a deposit taker, this risk arises from its role in maturity

transformation, where liabilities are typically short term (for example, demand

deposits), while its assets have a longer maturity and are often illiquid (for

example, loans). Financial markets provide a forum within which financial

claims can be traded under established rules of conduct and can facilitate the

management and transformation of risk. They also play an important role in

identifying market prices (“price discovery”).

Structure of Financial System: The

main constituents of financial system are:

1. Financial Institutions

2. Financial Instruments, and

3.

Financial

Markets.

1. Financial

Institutions

The

modern name of Financial Institution is Financial Intermediary (FI), because it

mediates or stands between ultimate borrowers and ultimate lenders and helps

transfer funds from one to another. The Financial system helps production,

capital-accumulation and growth by encouraging savings and allocating them

among the alternative uses and users.

Overview of Financial system of Bangladesh

The financial system of Bangladesh is comprised

of three broad fragmented sectors:

1. Formal Sector

2. Semi-Formal Sector

3. Informal Sector

The sectors have

been categorized in accordance with their degree of regulation.

1.

The formal sector includes all regulated institutions like Banks, Non-Bank Financial Institutions (FIs), Insurance

Companies, Capital Market Intermediaries like Brokerage Houses, Merchant Banks etc.; Micro Finance Institutions (MFIs).

2.

The semi-formal sector includes those institutions which are regulated

otherwise but do not fall under the jurisdiction of Central Bank, Insurance

Authority, Securities and Exchange Commission or any other enacted financial

regulator. This sector is mainly represented by Specialized Financial Institutions like House Building Finance Corporation (HBFC), Palli

Karma Sahayak Foundation (PKSF), Samabay Bank, Grameen Bank etc., Non Governmental Organizations (NGOs and discrete

government programs. According to

statistics of Bangladesh NGO Bureau, 2356 NGOs are working in Bangladesh (31th December, 2014)

3. The informal

sector includes private intermediaries

which are completely unregulated.

1.

Formal

Sector

A. Banks:

After the independence, banking industry in Bangladesh started its journey with

6 nationalized commercialized banks, 2 State owned specialized banks and 3

Foreign Banks. In the 1980's banking industry achieved significant expansion

with the entrance of private banks. Now, banks in Bangladesh are primarily of two types:

1. Scheduled Banks: The banks

which get license to operate under Bank Company Act, 1991 (Amended in 2003) are

termed as Scheduled Banks.

2.

Non-Scheduled

Banks: The

banks which are established for special and definite objective and operate

under the acts that are enacted for meeting up those objectives, are termed as

Non-Scheduled Banks. These banks cannot perform all functions of scheduled

banks.

1. Scheduled

banks:

There are 56 scheduled banks in

Bangladesh who operate under full control and supervision of Bangladesh Bank

which is empowered to do so through Bangladesh Bank Order, 1972 and Bank

Company Act, 1991. Scheduled Banks are classified into following types:

State Owned Commercial Banks (SOCBs): There

are 5 SOCBs which are fully or majorly owned by the Government

of Bangladesh.

Specialized Banks (SDBs): 3 specialized banks are

now operating which were established for specific objectives like agricultural

or industrial development. These banks are also fully or majorly owned by the

Government of Bangladesh.

Private Commercial Banks (PCBs): There

are 39 private commercial banks which are majorly owned by the

private entities. PCBs can be categorized into two groups:

Conventional PCBs: 31 conventional PCBs are

now operating in the industry. They perform the banking functions in

conventional fashion i.e interest based operations.

Islami Shariah based PCBs: There are 8 Islami Shariah

based PCBs in Bangladesh and they execute banking activities according

to Islami Shariah based principles i.e. Profit-Loss Sharing (PLS) mode.

Foreign Commercial Banks (FCBs): 9 FCBs are

operating in Bangladesh as the branches of the banks which are incorporated in

abroad.

2. Non-Scheduled Banks: There are now 4

non-scheduled banks in Bangladesh which are:

Ansar VDP Unnayan Bank,

Karmashangosthan Bank,

Probashi Kollyan Bank,

Jubilee Bank

B.

Non-Bank Financial Institutions (FIs):

Non-Bank Financial Institutions (FIs) are those types of financial institutions

which are regulated under Financial Institution Act, 1993 and controlled by

Bangladesh Bank. Now, 31 FIs are operating in Bangladesh while

the maiden one was established in 1981. Out of the total, 2 is fully government

owned, 1 is the subsidiary of a SOCB, 13 were initiated by private domestic

initiative and 15 were initiated by joint venture initiative. Major sources of

funds of FIs are Term Deposit (at least six months tenure), Credit Facility

from Banks and other FIs, Call Money as well as Bond and Securitization.

The major difference between banks

and FIs are as follows:

1. FIs cannot

issue cheques, pay-orders or demand drafts.

2. FIs cannot

receive demand deposits,

3. FIs cannot

be involved in foreign exchange financing,

4. FIs can

conduct their business operations with diversified financing modes like

syndicated financing, bridge financing, lease financing, securitization

instruments, private placement of equity etc.

List of Non-Bank Financial

Institutions (FIs) in Bangladesh:

Uttara Finance and Investments Limited

United Leasing Company Limited (ULCL)

Union Capital Limited

The UAE-Bangladesh Investment Co. Ltd

Saudi-Bangladesh Industrial & Agricultural Investment Company

Limited (SABINCO)

Reliance Finance Limited

Prime Finance & Investment Ltd

Premier Leasing & Finance Limited

Phoenix Finance and Investments Limited

People's Leasing and Financial Services Ltd

National Housing Finance and Investments Limited

National Finance Ltd

MIDAS Financing Ltd. (MFL)

LankaBangla Finance Ltd.

Islamic Finance and Investment Limited

International Leasing and Financial Services Limited

Infrastructure Development Company Limited (IDCOL)¿

Industrial Promotion and Development Company of Bangladesh

Limited(IPDC)

Industrial and Infrastructure Development Finance Company (IIDFC)

Limited

IDLC Finance Limited

Hajj Finance Company Limited

GSP Finance Company (Bangladesh) Limited (GSPB)

First Lease Finance & Investment Ltd.

FAS Finance & Investment Limited

Fareast Finance & Investment Limited

Delta Brac Housing Finance Corporation Ltd. (DBH)

Bay Leasing & Investment Limited

Bangladesh Industrial Finance Company Limited (BIFC)

Bangladesh Finance & Investment Co. Ltd.

Agrani SME Finance Co. Ltd.

C.

Insurance

sector in Bangladesh:

Insurance

sector in Bangladesh emerged after independence with 2 nationalized insurance

companies- 1 Life & 1 General; and 1 foreign insurance company. In mid 80s,

private sector insurance companies started to enter in the industry and it got

expanded. Now days, 62 companies are operating under Insurance Act 2010. Out of

them- 18 are Life Insurance Companies including 1 foreign company and 1 is

state-owned company, 44 General Insurance Companies including 1 state-owned

company.

Insurance companies in Bangladesh

provide following services:

Life

insurance,

General

Insurance,

Reinsurance,

Micro-insurance,

Takaful or

Islami insurance

LIST OF NON-LIFE INSURANCE COMPANIES

- Agrani

Insurance Company Ltd.

- Asia

Insurance Ltd.

- Asia

Pacific Gen Insurance Co. Ltd.

- Bangladesh

Co-operatives Ins. Ltd.

- Bangladesh

General Insurance Co. Ltd.

- Bangladesh

National Insurance Co.Ltd.

- Central

Insurance Company Ltd.

- City

Gen. Insurance Company Ltd.

- Continental

Insurance Ltd.

- Crystal

Insurance Company Ltd.

- Desh

Gen. Insurance Company Ltd.

- Eastern

Insurance Company Ltd.

- Eastland

Insurance Company Ltd.

- Express

Insurance Ltd.

- Federal

Insurance Company Ltd.

- Global

Insurance Ltd.

- Green

Delta Insurance Co. Ltd.

- Islami

Commercial Insurance Co. Ltd.

- Islami

Insurance Bangladesh Ltd.

- Janata

Insurance Company Ltd.

- Karnaphuli

Insurance Company Ltd.

- Meghna

Insurance Company Ltd.

- Mercantile

Insurance Company Ltd.

- Nitol

Insurance Company Ltd.

- Northern

Gen.Insurance Company Ltd.

- Peoples

Insurance Company Ltd.

- Phonix

Insurance Company Ltd.

- Pioneer

Insurance Company Ltd.

- Pragati

Insurance Ltd.

- Pramount

Insurance Company Ltd.

- Prime

Insurance Company Ltd.

- Provati

Insurance Company Ltd.

- Purabi

Gen Insurance Company Ltd.

- Reliance

Insurance Ltd

- Republic

Insurance Company Ltd.

- Rupali

Insurance Company Ltd.

- Sonar

Bangla Insurance Company Ltd.

- South

Asia Insurance Company Ltd.

- Standard

Insurance Ltd.

- Takaful

Islami Insurance Ltd.

- Dhaka

Insurance Ltd.

- Union

Insurance Company Ltd.

- United

Insurance Company Ltd.

LIST OF

LIFE INSURANCE COMPANIES

- American

Life Insurance Company (Foreign Company)

- Baira

Life Insurance Company Ltd.

- Delta

Life Insurance Company Ltd.

- Farest

Islami Life Insurance Co. Ltd.

- Golden

Life Insurance Ltd.

- Homeland

Life Insurance Company Ltd.

- Meghna

Life Insurance Company Ltd.

- National

Life Insurance Company Ltd.

- Padma

Islami Life Insurance Company Ltd.

- Popular

Life Insurance Company Ltd.

- Pragati

Life Insurance Ltd.

- Prime

Islami Life Insurance Company Ltd.

- Progressive

Life Insurance Company Ltd.

- Rupali

Life Insurance Company Ltd.

- Sandhani

Life Insurance Company Ltd.

- Sunflower

Life Insurance Company Ltd.

- Sunlife

Insurance Company Ltd

LIST OF THE INSURANCE COMPANIES IN

PUBLIC SECTOR

- Sadharan

Bima Corporation(Gen. Ins)

- Jiban

Bima Corporation (Life Ins.)

D.

Microfinance

Institutions (MFIs):

The

member-based Microfinance Institutions (MFIs) constitute a rapidly growing

segment of the Rural Financial Market (RFM) in Bangladesh. Microcredit programs

(MCP) in Bangladesh are implemented by various formal financial institutions

(nationalized commercial banks and specialized banks), specialized government

organizations and Non-Government Organizations (NGOs). The growth in the MFI

sector, in terms of the number of MFI as well as total membership, was

phenomenal during the 1990s and continues till today.

Despite the fact that more than a thousand of institutions are operating

microcredit programs, but only 10 large Microcredit Institutions (MFIs) and

Grameen Bank represent 87% of total savings of the sector and 81% of total

outstanding loan of the sector. Through the financial services of microcredit,

the poor people are engaging themselves in various income generating activities

and around 30 million poor people are directly benefited from microcredit

programs.

Credit services of this sector can be categorized into six broad groups: i)

general microcredit for small-scale self employment based activities, ii)

microenterprise loans, iii) loans for ultra poor, iv) agricultural loans, v)

seasonal loans, and vi) loans for disaster management.

Currently,

599 institutions (as of October 10, 2011) have been licensed by MRA to operate

Micro Credit Programs. But, Grameen Bank is out of the jurisdiction of MRA as

it is operated under a distinct legislation- Grameen Bank Ordinance, 1983.

2.

Financial market:

Financial market in Bangladesh: The financial market in Bangladesh is

mainly of following types:

1.

Money

Market: The primary money market is comprised of banks,

FIs and primary dealers as intermediaries and savings & lending

instruments, treasury bills as instruments. There are currently 15 primary

dealers (12 banks and 3 FIs) in Bangladesh. The only active secondary market is

overnight call money market which is participated by the scheduled banks and

FIs. The money market in Bangladesh is regulated by Bangladesh Bank (BB), the

Central Bank of Bangladesh.

2.

Capital

market: The

primary segment of capital market is operated through private and public

offering of equity and bond instruments. The secondary segment of capital

market is institutionalized by two (02) stock exchanges-Dhaka Stock Exchange

and Chittagong Stock Exchange. The instruments in these exchanges are equity

securities (shares), debentures, corporate bonds and treasury bonds. The

capital market in Bangladesh is governed by Securities and Commission (SEC).

3.

Foreign

Exchange Market: Towards liberalization of foreign exchange

transactions, a number of measures were adopted since 1990s. Bangladeshi

currency, the taka, was declared convertible on current account transactions

(as on 24 March 1994), in terms of Article VIII of IMF Article of Agreement

(1994). As Taka is not convertible in capital account, resident owned capital

is not freely transferable abroad. Repatriation of profits or disinvestment

proceeds on non-resident FDI and portfolio investment inflows are permitted

freely. Direct investments of non-residents in the industrial sector and

portfolio investments of non-residents through stock exchanges are repatriable

abroad, as also are capital gains and profits/dividends thereon. Investment

abroad of resident-owned capital is subject to prior Bangladesh Bank approval,

which is allowed only sparingly.

Bangladesh adopted Floating Exchange Rate regime since

31 May 2003. Under the regime, BB does not interfere in the determination of

exchange rate, but operates the monetary policy prudently for minimizing

extreme swings in exchange rate to avoid adverse repercussion on the domestic

economy. The exchange rate is being determined in the market on the basis of

market demand and supply forces of the respective currencies.

In the forex market, banks are free to buy and sale

foreign currency in the spot and also in the forward markets. However, to avoid

any unusual volatility in the exchange rate, Bangladesh Bank, the regulator of

foreign exchange market remains vigilant over the developments in the foreign

exchange market and intervenes by buying and selling foreign currencies

whenever it deems necessary to maintain stability in the foreign exchange

market.

3.

Financial

instruments:

Money

Market Instruments: Money market claim

mature in less than one year. Because of their short-term maturity, money

market instruments undergo the least price fluctuations and so are the risky

investments.

The common types of money market securities traded

in Bangladesh are given below:

2. Repurchase

Agreements ( Repo or Reverse Repo)

3. Commercial

Papers

4. Certificate

of Deposit

5. Banker's

Acceptance

6. Call

money

Money

market participants

Banks, Non-bank, Financial Institutions

(takaful companies), business corporations, government and central bank

Capital market instruments:

Debt

and equity instruments wit maturity of over one year called capital market

instruments. They have far wider price fluctuations than money market

instruments and are considered to fairly risky instruments.

1. Common

stocks/Equity

2. Bonds

3. Mortgages

4. Futures

5. Options

Difference

between money market and capital market:

|

|

Money Market

|

Capital Market

|

|

Definition

|

Is

a component of the financial markets where short-term borrowing takes place

|

Is

a component of financial markets where long-term borrowing takes place

|

|

Maturity

Period

|

Lasts

anywhere from 1 hour to 90 days.

|

Lasts

for more than one year and can also include life-time of a company.

|

|

Credit

Instruments

|

Certificate

of deposit, Repurchase agreements, Commercial paper, Eurodollar deposit,

Federal funds, Municipal notes, Treasury bills, Money funds, Foreign Exchange

Swaps, short-lived mortgage and asset-backed securities.

|

Stocks,

Shares, Debentures, bonds, Securities of the Government.

|

|

Nature

of Credit Instruments

|

Homogenous.

A lot of variety causes problems for investors.

|

Heterogeneous.

A lot of varieties are required.

|

|

Purpose

of Loan

|

Short-term

credit required for small investments.

|

Long-term

credit required to establish business, expand business or purchase fixed

assets.

|

|

Basic

Role

|

Liquidity

adjustment

|

Putting

capital to work

|

|

Institutions

|

Central

banks, Commercial banks, Acceptance houses, Nonbank financial institutions,

Bill brokers, etc.

|

Stock

exchanges, Commercial banks and Nonbank institutions, such as Insurance

Companies, Mortgage Banks, Building Societies, etc.

|

|

Risk

|

Risk

is small

|

Risk

is greater

|

|

Market

Regulation

|

Commercial

banks are closely regulated to prevent occurrence of a liquidity crisis.

|

Institutions

are regulated to keep them from defrauding customers.

|

|

Relation

with Central Bank

|

Closely

related to the central banks of the country.

|

Indirectly

related with central banks and feels fluctuations depending on the policies

of central banks.

|

Islamic Financial system:

1. A

financial system that is based on Islamic principles and values, which

eliminates Riba and ensure a profit sharing mechanism in the financial system,

may be called IFS.

2. It

may be characterized by the absence' of interest based financial institution

& transactions, doubtful transactions or Gharar, Stocks of companies

dealing in unlawful activities, unethical or immoral transactions such as

market manipulation, insider trading short-selling etc.

Principles/features

of an Islamic financial system:

The basic framework for

an Islamic financial system is a set of rules and laws, collectively referred

to as Shariah, governing economic, social, political and cultural aspects of Islamic

societies. Shariah originates from the rules dictated by the Quran and its

practices, and explanations rendered (more commonly known as Sunnah) by the

Prophet Muhammad. Further elaboration of the rules is provided by scholars in

Islamic jurisprudence within the framework of the Quran and Sunnah. The basic

principles of an Islamic financial system can be summarized as follows:

1. Prohibition of interest: Prohibition of Riba, a

term literally meaning "an excess" and interpreted as "any

unjustifiable increase of capital whether in loans or sales" is the

central tenet of the system. More precisely, any positive, fixed, predetermined

rate tied to the maturity and the amount of principal (i.e.) guaranteed

regardless of the performance of the investment) is considered Riba and is

prohibited. The general consensus among Islamic scholars is that Riba covers

not only usury but also the charging of "interest" as widely

practiced.

2. This prohibition is based on arguments of social justice,

equality, and property rights. Islam encourages the earning of profits but

forbids the charging of interest because profits, determined ex post, symbolize

successful entrepreneurship and creation of additional wealth whereas interest,

determined ex ante, is a cost that is accrued irrespective off the outcome of

business operations and may not create wealth if there are business losses.

Social justice demands that borrowers and lenders share rewards s well as

losses in an equitable fashion and that the process of wealth accumulation and

distribution in the economy be fair and representative of true productivity.

3. Risk sharing: Because interest is prohibited, suppliers of

funds become investors instead of creditors. The provider of financial capital

and the entrepreneur share business risks in return for shares of the profits.

4. Money as "Potential" Capital: Money is treated as

"Potential" capital -that is, it becomes actual capital only when it

joins hands with other resources to undertake a productive activity. Islam

recognizes the time value of money, but only when it acts as capital, not when

it is "Potential" capital.

5. Prohibition of speculative behavior: An Islamic financial

system discourages hoarding and prohibits transactions featuring extreme uncertainties,

gambling, and risks

6. Sanctity of contracts: Islam upholds contractual obligations and the

disclosure of information as a sacred duty. This feature is intended to reduce

the risk of asymmetric information and moral hazard.

7. Shariah approved activities: Only those business activities

that do not violate the rules of Shariah qualify for investment. For example,

any investment in businesses dealing with alcohol, gambling, and casinos would

be prohibited.

Differences

between CFS & IFS:

The

conventional financial system consists of Socialistic financial system and

Capitalistic financial system. Both

systems have been proved inefficient to establish economic balance in the

society.

|

Basis

of Difference

|

CFS

|

IFS

|

|

Religious Belief

|

Secular & separates Religion from other Parts human life

|

Belief in unity of God & relates this belief to economic Life of a man

|

|

Freedom of Economic

Activity

|

In socialism govt. enjoys economic freedom but in capitalism Individuals enjoys freedom.

|

Restrictive freedom is allowed in the light of

Shariah both by the govt. &/or individuals

|

|

Ownership of means

|

Socialism-state ownership, Capitalism-individual ownership

|

Allah is the exclusive owner. Man is the caretaker of the property

|

|

Goals of financial System

|

Socialism-profit of the society

Capitalism-Individual’s profit

|

Welfare of both here and hereafter.

|

|

Competition

|

Socialism-No competition

Capitalism- Logical & unethical competition

|

Logical Competition and financial co-operation

|

|

Wealth distribution

|

Socialism-Equal

Capitalism – Unequal

|

Equitable

|

|

Basis of Economic

System

|

Riba or Interest

|

Interest Free; PLS,

Zakat & Compensation based

|

|

Sources of the System

|

Intellects brain

storming of the economic problems of men’s life

|

Devine book “Al-Quran”

& Prophets(SM) speeches

|

|

Result

|

Capitalism concentration

of income & economic power in few hands. Inefficiency

|

Maximum & equitable

Distribution of economic opportunities and higher production in the society

|

|

Social &

environmental welfare

|

Do not consider the

social & environmental welfare

|

Ensure social &

environmental welfare

|

|

Owners exception in

respect of respect of investment

|

Dividend or part of

profit in case of equity financing

|

Part of Profit or Loss

|

|

Lender or Bank’s

expectation in terms of dept financing

|

Interest

|

Profit or Loss Sharing

|

|

Modes of Investment

|

Loan, Overdraft & Cash Credit

|

Mudarabah, Musharaka, Murabaha etc.

|

Need

for Islamic Money Market

Islamic bank also faced also exposed to

liquidity risk. Like conventional, Islamic bank hold illiquid assets while

liability relatively liquid. Bank with surplus funds can either lend by placing

deposit system with other banks in interbank deposit system or lend by

purchasing money market instruments.

Different

between Islamic and Conventional Money Market

|

|

Conventional

|

Islamic

|

|

1) Interbank

Market

|

Issues debt contract for placement of fund

|

Apply Shariah contracts i.e mudharabah, murabahah

and wakalah

|

|

2)

Instruments Issuance process

|

Approved by respective regulators

|

Approved by Shariah Committee and respective

regulators.

|

|

Structure

|

Structured based on debt only

|

Structure based on assets, equity and debt based.

|

|

Investors

|

Conventional

investors only.

|

Conventional

and Islamic investors.

|

Islamic

Money market instruments:

Islamic Inter-bank Fund Market (IIFM) – Bangladesh, the separate call money

market for Islamic banks in Bangladesh

Islamic Inter-bank

Fund Market (IIFM) -- for sharia-based banks started its journey on June 3,

2012. In such a market, transactions are based on profit instead of interest. Bangladesh

Bank Governor Atiur Rahman inaugurated the IIFM at the central bank.

On the first day,

Islami Bank Bangladesh Ltd offered funds worth Tk 100 crore, while four banks

applied for taking Tk 60 crore from the funds.

The BB governor said

the IIFM has been formed in the model of the traditional call money market to

remove the temporary and short-term liquidity crisis of the Islamic banks. The

Islamic Bond Fund of the central bank will act as the custodian of the IIFM and

will not charge any fees for the fund.

According to rules,

if any bank has excess fund, it will invest the amount in the IIFM for one day.

Another Islamic bank requiring fund will borrow the money from the IIFM for one

day. The rate of profit in the Islamic bank call money market will be

determined on the basis of the profit the bank gives to its depositors on a

three months' deposit.

Foreign

exchange market in Islam:

The rule of trade in

currencies:

Currency trading may be permissible on one condition that the

payment should occur on the same in the contract’s council, if the currency is

equal The evidence narrated by Abada Ben Al-Samit may Allah be pleased with him

said: The Messenger of Allah peace be upon him: (gold for gold, silver for

silver, wheat for wheat, barley for barley, dates for dates, salt for salt,

like for like, hand in hand, if these types are different the sell as you like,

hand in hand) Narrated by Muslim (1587).

The “Total Fataawa Ibn Baaz”

(19/171- 174):

Transactions, buying

and selling in currencies are permissible, but only if the exchange be hand in

hand if the currencies were different, Example selling the currency of the

Libyan currency exchange for the U.S. Dollars or Egypt the transaction

should be done hand in hand within the council, but if the payment was

delayed or differed then it’s not permissible, because that case it is

considered a form of usury-based (Riba) transaction, it must be the same

sitting of the Council hand in hand if the currency is different, but if they

are of one type must be two conditions: symmetry and same sitting of the

Council, as per the Prophet saying peace be upon him: (gold for gold , and

silver with silver… Then he mentioned the Hadith).

And currencies as

before if it was different then it is permissible with the differentiation and

payment may be in the same sitting of the Council, and if one type such as

dollars, dollars, or dinars, dinars must be in the same sitting of the Council,

and uniformity.

Islamic financial instruments:

IDC, IIC and MB

Three potential instruments proposed in the Seminar on Developing a

System of Financial Instruments, jointly sponsored by the Islamic Development

Bank and the Government of Malaysia, held in Kuala Lumpur 1986, were

Islamic

Deposit Certificates (IDCs),

Islamic Investment Certificates (IICs) and

Muqarada Bonds (MBs).

These appeared promising the IDC proceeds are meant to be

used by the issuing bank for general purposes, while IIC proceeds are meant for

investment in a specific project or activity by the issuing bank. The MBs

proceeds are meant to be used for income-yielding public utility projects, such

as electricity and telecommunications, and infrastructure development projects

such as construction of roads and bridges.

The common denominator for all the above three instruments is that they

are all based on the principle of profit sharing. The holders of IDC and IIC

will also share in the losses, if any, but not the holders of MBs, as the

nominal value of MBs would be guaranteed by the Government, which is a third

party independent from the other two. It is of interest to note that Muqarada

Bonds have already been adopted as a financial instrument in Jordan, though

with a limited scope.